Recent News

02/14/2025

On developing an effective IT modernization strategy

Information technology (IT) is constantly evolving. As the owner of a small to midsize business, you’ve probably been told this so often that you’re tired of hearing it. Yet technology’s ceaseless march into the future continues and, apparently, many companies aren’t so sure they can keep up. In October of last year, IT infrastructure services provider Kyndryl released its 2024 Kyndryl Readiness Report. It disclosed the results of a survey of 3,200 senior decision-makers across 25 industries in 18 global markets, including the United States. The survey found that, though 90% of respondents describe their IT infrastructures as “best in class,”...

Stay up to date! Subscribe to our future blog posts!

06/30/2023

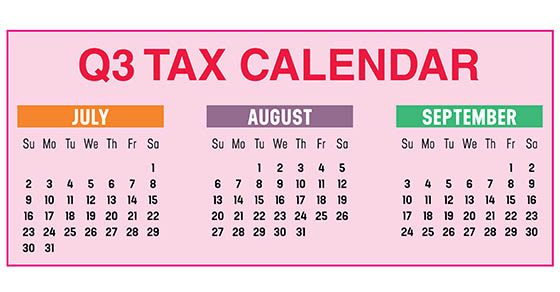

2023 Q3 tax calendar: Key deadlines for businesses and other employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the third quarter of 2023. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. July 31 Report income tax withholding and FICA taxes for second quarter 2023 (Form 941) and pay any tax due. (See the exception below, under “August 10.”) File a 2022 calendar-year retirement plan report (Form 5500 or Form 5500-EZ) or request an extension. August 10 Report income...

06/27/2023

Hiring Family members can offer tax advantages(but be careful)

Summertime can mean hiring time for many types of businesses. With legions of working-age kids and college students out of school, and some spouses of business owners looking for part-time or seasonal work, companies may have a much deeper hiring pool to dive into this time of year. If you’re considering hiring your children or spouse, there could be some tax advantages in play. However, you’ll need to be careful about following the IRS rules. Employing your kids Children who work for the business of a parent are subject to income tax withholding regardless of age. If the company is a partnership...

10/25/2022

Manageable Growth Should Be a Strategic Planning Focus

When a company’s leadership engages in strategic planning, growing the business is typically at the top of the agenda. This is as it should be — ambition is part and parcel of being a successful business owner. What’s more, in many industries, failing to grow could leave the company at the mercy of competitors. However, unbridled growth can be a dangerous thing. A business that expands too quickly can soon run out of working capital. And the very leaders who pushed the business to grow beyond its means might find themselves spread too thin and burned out. That’s why, as...

10/11/2022

Shine a Light on Sales Prospects to Brighten the Days Ahead

When it comes to sales, most businesses labor under two major mandates: 1) Keep selling to existing customers, and 2) Find new ones. To accomplish the former, your sales staff probably gets some help from the marketing and customer service departments. Succeeding at the latter may be more difficult. Yet perhaps the most discernible way a sales department can help boost a company’s bottom line is to win over prospects consistently and manageably. Laser Focus on Lead Generation Does your marketing department help you generate leads by doing things such as maintaining an easily searchable database of potential customers for...

09/27/2022

Work Opportunity Tax Credit Provides Help to Employers

In today’s tough job market and economy, the Work Opportunity Tax Credit (WOTC) may help employers. Many business owners are hiring and should be aware that the WOTC is available to employers that hire workers from targeted groups who face significant barriers to employment. The credit is worth as much as $2,400 for each eligible employee ($4,800, $5,600 and $9,600 for certain veterans and $9,000 for “long-term family assistance recipients”). It’s generally limited to eligible employees who begin work for the employer before January 1, 2026. The IRS recently issued some updated information on the pre-screening and certification processes. To...

09/21/2022

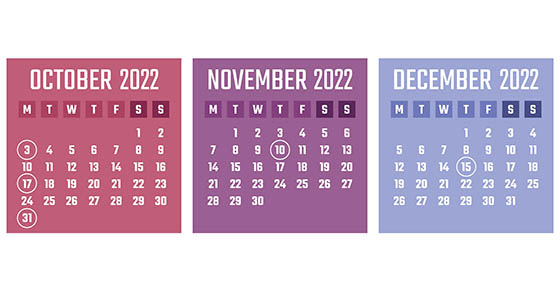

2022 Q4 Tax Calendar: Key Deadlines for Businesses and Other Employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. Note: Certain tax-filing and tax-payment deadlines may be postponed for taxpayers who reside in or have businesses in federally declared disaster areas. Monday, October 3 The last day you can initially set up a SIMPLE IRA plan, provided you (or any predecessor employer) didn’t previously maintain...